Adverts

Have you ever stopped to think about how much easier it would be to manage your finances with the help of an app?

Adverts

With the increasingly digitized world, smartphones have become our best friends, and it's time for us to harness their full potential to improve our financial health.

If you've ever found yourself lost in a sea of receipts, outdated spreadsheets, and unexpected expenses, don't worry!

Adverts

We're here to show you how some amazing apps can transform the way you handle your money.

Get ready to discover the secrets of financial apps and take a leap towards full control of your personal finances!

furniture

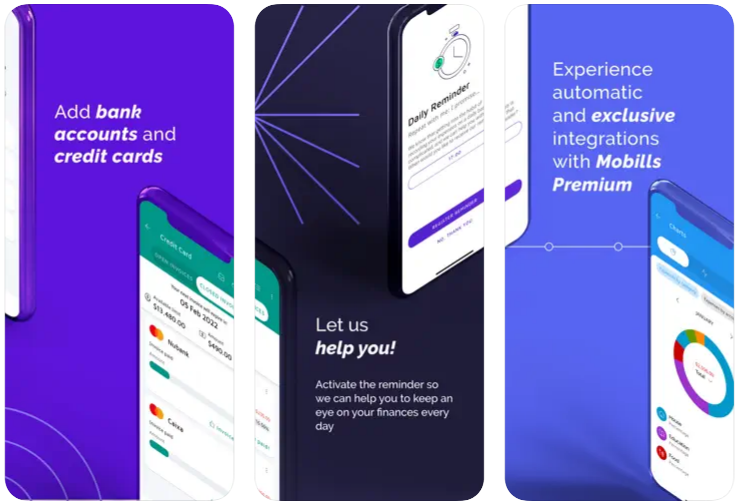

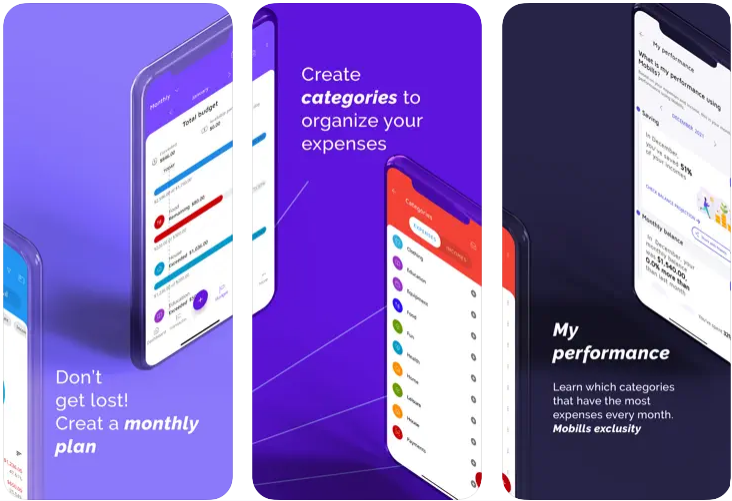

Mobills is a popular personal financial control app that helps people manage their finances efficiently. With an intuitive interface and comprehensive features, Mobills allows users to track their expenses, set budgets, record revenues, track debt, and more.

One of the main features of Mobills is its ability to automatically categorize transactions, making it easier to track spending in different areas, such as food, transportation, housing, among others.

In addition, the app offers detailed charts and reports, allowing users to have a clear view of their financial situation.

See too:

Mobills also has accounts payable reminder features, helping to avoid delays and additional charges. In addition, you can synchronize the app with bank accounts and credit cards to get automatic updates of transactions.

mint

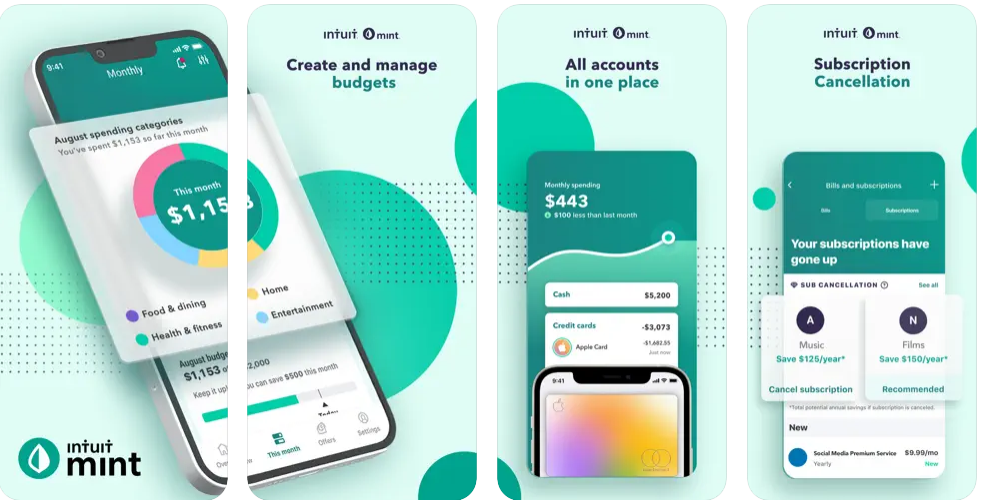

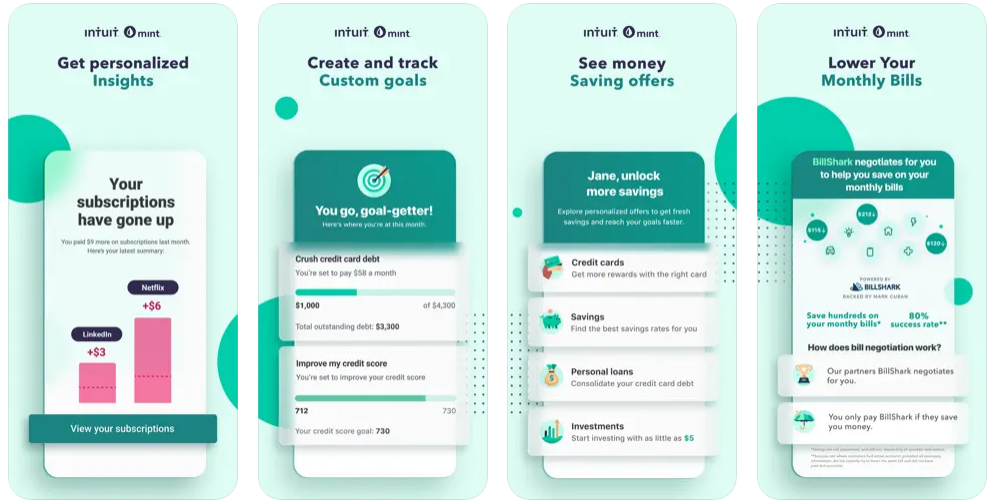

Mint is a widely used personal financial management app that offers a variety of features to help people take control of their finances. The app allows users to track their expenses, create budgets, monitor their bank accounts and credit cards, and receive personalized financial insights.

One of the key features of Mint is its ability to consolidate financial information from multiple sources in one place. Users can connect their bank accounts, credit cards, investments, and even their loan accounts to get a complete picture of their finances.

Mint automatically categorizes transactions, which makes it easier to understand how money is being spent. It also allows users to set financial goals and receive alerts when they are approaching their budget limits.

The app provides detailed charts and reports, giving you a clear and visually appealing view of money flow and spending patterns. In addition, Mint sends notifications to remind users about account expiration dates and helps identify savings opportunities.

YNAB (You Need a Budget)

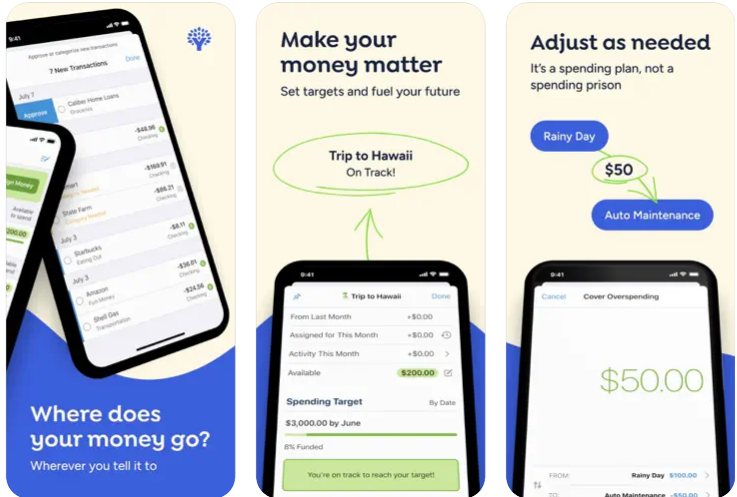

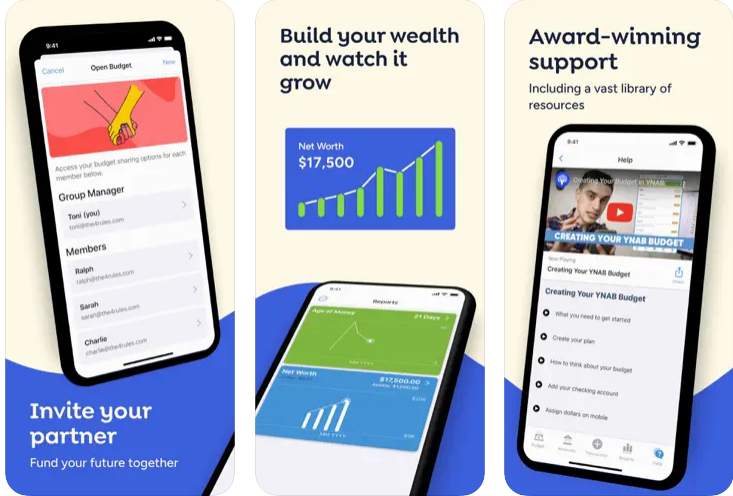

YNAB (You Need a Budget) is a financial budgeting app that focuses on helping people control their expenses, save money, and eliminate debt. It follows a methodology of four fundamental rules to promote a disciplined approach to money.

It allows users to create detailed budgets by assigning specific categories to their expenses. This helps you keep track of where the money is going and make more conscious financial decisions.

It encourages users to assign every penny to a spending category, ensuring they are aware of their current financial situation and avoid spending more than they have available.

YNAB also provides resources to deal with debt. It helps users prioritize debt repayment strategically, giving them a clear view of the amounts that need to be paid and allowing them to establish a plan to get rid of them.

In addition, YNAB offers support and educational resources, such as courses and articles, to help users improve their understanding of personal finance and develop skills to make sound financial decisions.

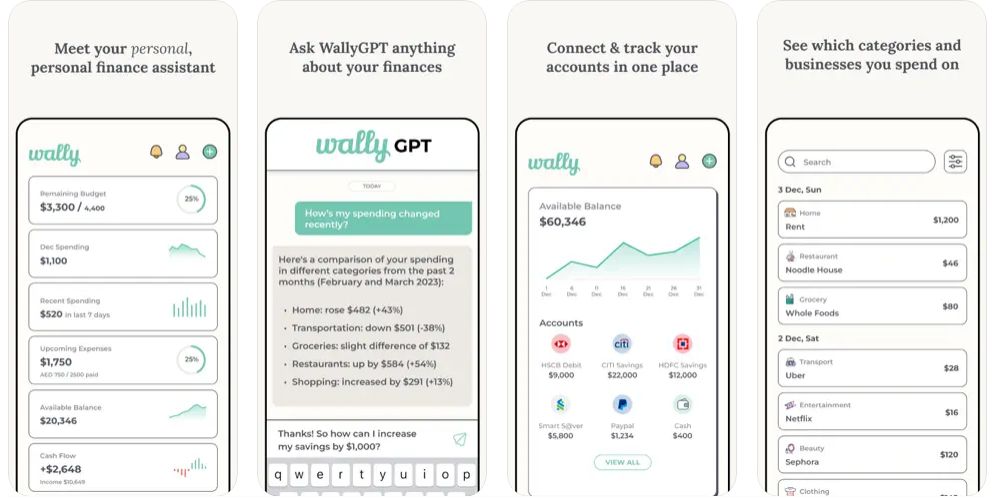

wally

Wally is a personal financial control app designed to help users keep track of their expenses, save money, and keep their finances organized.

One of Wally's key features is the ability to quickly record expenses and income. Users can enter information manually or even scan receipts to keep an accurate record of their financial transactions.

The app automatically categorizes expenses based on previous patterns, making it easy to analyze where the money is being spent. It also provides useful insights into users' spending patterns, allowing them to identify areas where they can save or adjust their financial habits.

In addition, Wally allows users to set financial goals, such as saving for a trip or paying off a specific debt. The app tracks progress toward these goals and offers reminders to help users stay focused on their goals.

Money Lover

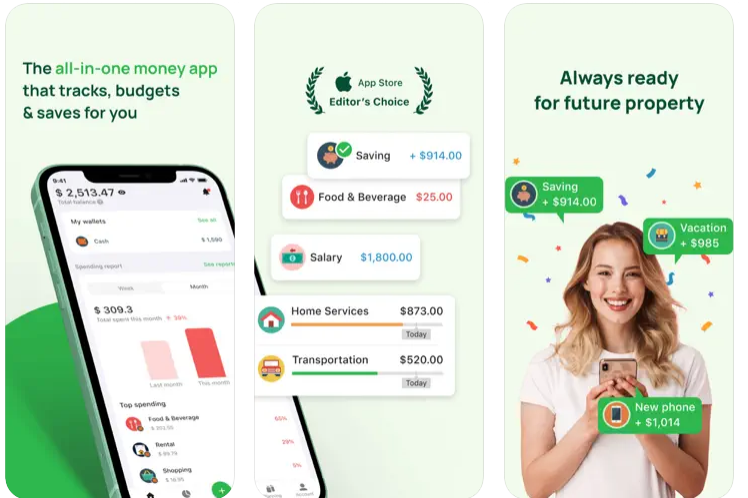

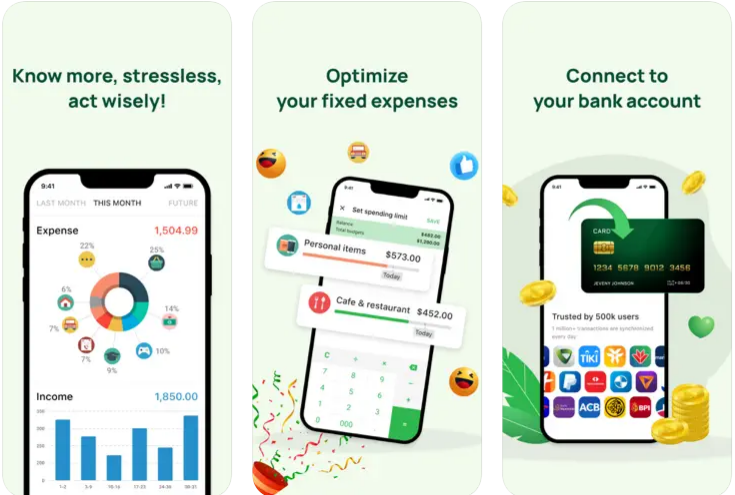

Money Lover is a personal financial control app that helps users monitor their expenses, track their income, and manage their finances efficiently.

One of the main features of Money Lover is its ability to easily record expenses and income. Users can add transactions manually, take photos of receipts, or even import bank statements to keep an accurate record of their finances.

The app automatically categorizes transactions, allowing users to have a clear view of their spending in different areas such as food, transportation, entertainment, etc. This helps in the analysis and control of consumption habits.

In addition, Money Lover offers budgeting features, allowing users to set financial goals and monitor their progress. You can set spending limits for specific categories and receive notifications when they are being exceeded.